How a Wall Street Exile Transformed $250K into a Better-For-You Empire

[Sponsored Ad]

I’ve been using Ketone-IQ to sharpen my mental focus, sustain clean energy, and keep my brain firing on all cylinders throughout the day and after speaking with the team, they’ve agreed to give you an exclusive 30% off your order: Grab yours here.

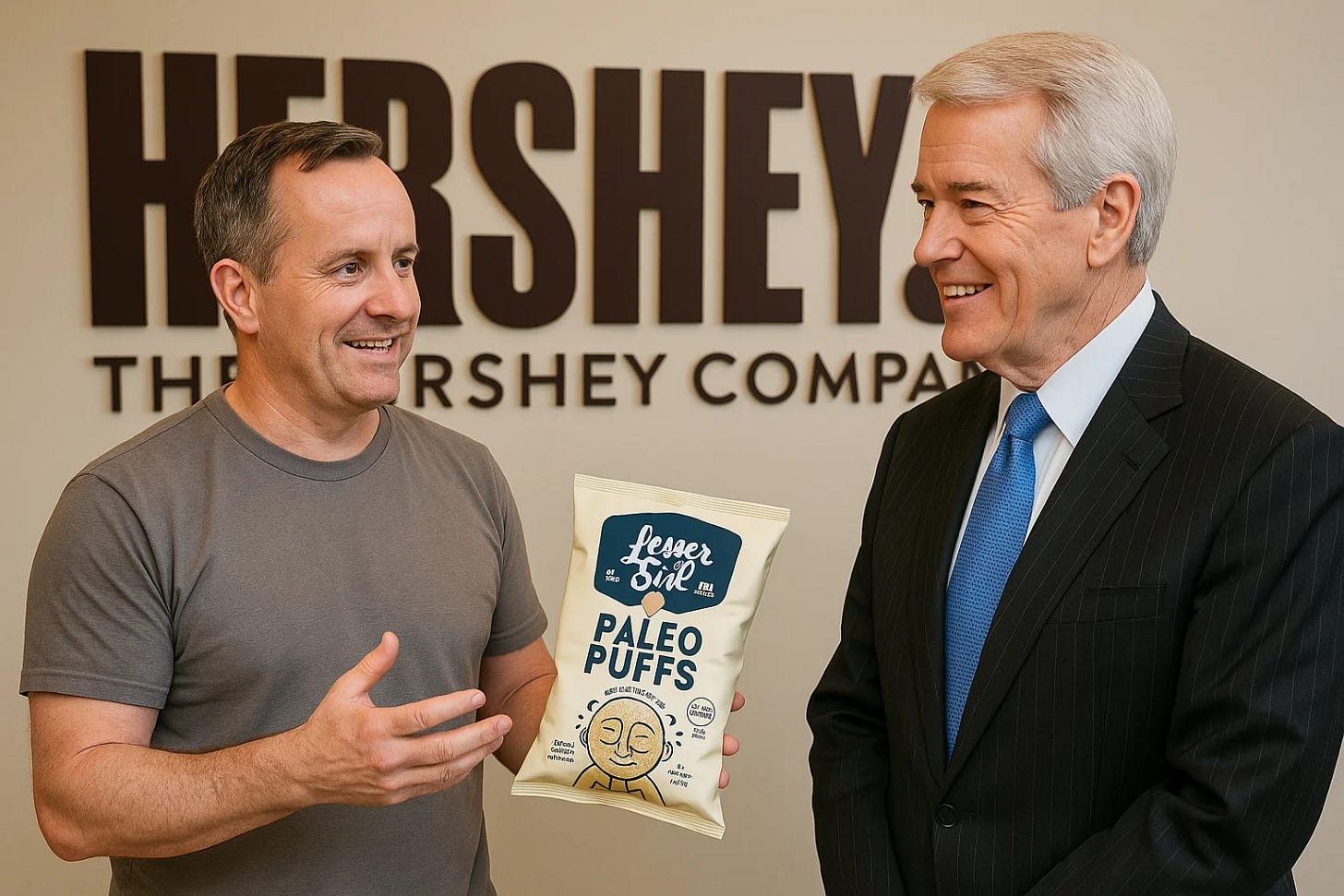

In a major industry move, The Hershey Company (NYSE: HSY) has announced its acquisition of better-for-you snack brand LesserEvil for approximately $750 million. This strategic purchase marks another significant step in Hershey's expansion beyond traditional confectionery into the booming health-conscious snack market.

But the real story here isn't just another corporate acquisition – it's the remarkable journey of Charles Coristine, the visionary who transformed a failing business into a snack empire worth three-quarters of a billion dollars.

From Wall Street to Entrepreneur

Before becoming a CPG industry innovator, Charles Coristine built his career in the high-pressure world of Wall Street. As a seasoned financial executive, he developed the sharp business acumen and strategic insight that would later serve him well in the competitive snack industry.

But Coristine was looking for something more meaningful – an opportunity to build something tangible, something that could positively impact consumer health while still satisfying snacking cravings.

The Risky Acquisition That Paid Off 3,000x

In 2011, Coristine made what many would consider a questionable business move: he purchased the struggling LesserEvil brand for just $250,000, plus a future payment of $100,000. At the time, LesserEvil was hemorrhaging money and generating less than $1 million in annual revenue.

Where others saw failure, Coristine saw opportunity.

The LesserEvil Rebuild

Coristine didn't just maintain the status quo – he completely reimagined what LesserEvil could become. His revolutionary approach included several key strategic shifts:

1. Management Overhaul

Coristine assembled a team of passionate food industry experts who shared his vision for creating truly better-for-you snacks without compromising on taste.

2. Vertical Integration

In perhaps his boldest move, Coristine brought manufacturing in-house rather than continuing to rely on expensive co-packers. This gave LesserEvil complete control over quality, ingredients, and production costs.

3. Brand Reinvention

Understanding that packaging drives consumer decisions, Coristine invested heavily in evolving LesserEvil's branding. The company's packaging transformed dramatically over 14 years, reflecting its commitment to constant improvement and authenticity.

4. Ingredient Innovation

Under Coristine's leadership, LesserEvil became obsessed with clean ingredients – removing artificial additives, incorporating organic components, and creating snacks that consumers could feel good about eating.

THE RESULTS SPEAK VOLUMES

Coristine's revolution worked. LesserEvil transformed from a failing brand into:

A powerhouse generating well over $100 million in annual revenue

A profitable business since 2021

A brand with devoted consumer following

A company worth $750 million to Hershey

This represents an astounding 3,000x return on Coristine's initial investment – a testament to his vision and execution.

5 CRITICAL LESSONS FROM THE LESSEREVIL SUCCESS STORY

1. Bet on Neglected Categories

Coristine recognized that the better-for-you snack segment was underserved but had massive growth potential. Sometimes the best opportunities aren't creating something entirely new, but revolutionizing what already exists.

2. Control Your Supply Chain

By bringing manufacturing in-house, LesserEvil gained cost advantages, quality control, and agility that competitors couldn't match. Vertical integration created both margin and innovation advantages.

3. Embrace Constant Iteration

LesserEvil didn't achieve perfection overnight. The company's willingness to continuously improve its products, packaging, and processes allowed it to stay ahead of market trends and consumer preferences.

4. Authenticity Sells

Rather than chasing gimmicks, Coristine built a brand with genuine commitment to better ingredients and transparent processes. This authenticity resonated with increasingly ingredient-conscious consumers.

5. Patient Capital Wins

Unlike many startups obsessed with rapid growth, Coristine took a long-term approach. It took a decade for LesserEvil to become profitable, but the patience paid off with extraordinary returns.

What This Means For The Industry

The LesserEvil acquisition is part of a larger trend of major CPG companies investing heavily in better-for-you brands:

PepsiCo acquired Poppi for $1.95 billion

PepsiCo acquired Siete Foods for $1.2 billion

Flowers Foods acquired Simple Mills for $795 million

Gryphon Investors acquired Spindrift for $650 million

For Hershey specifically, this continues CEO Michele Buck's strategic push into the salty snack category, following previous acquisitions of Dot's Pretzels ($1.2 billion in 2021) and Amplify Snack Brands/SkinnyPop ($1.6 billion in 2017).

One interesting question remains: How will Hershey manage potential cannibalization between SkinnyPop and LesserEvil, two brands now competing under the same corporate umbrella?

The LesserEvil Legacy

What Charles Coristine has accomplished with LesserEvil provides a masterclass in business transformation. By focusing on quality, innovation, vertical integration, and authentic branding, he proved that better-for-you doesn't mean boring or unprofitable.

For entrepreneurs and business leaders, the LesserEvil story demonstrates that with the right vision and execution, even the most challenging business situations can be transformed into extraordinary success.

Keep Building,

David