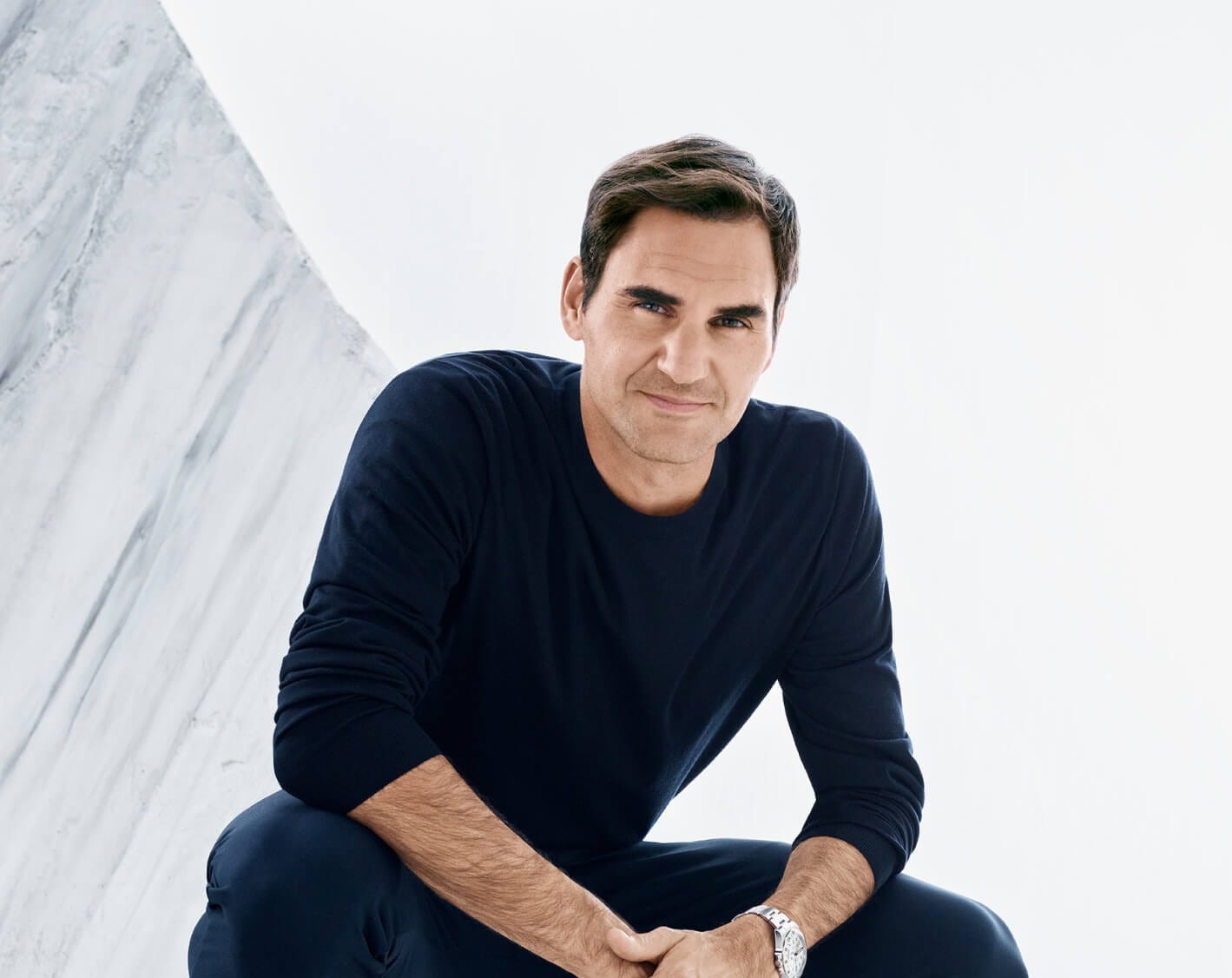

Roger Federer's is now Tennis' First Billionaire

[Sponsored Ad]

I’ve been using Ketone-IQ to sharpen my mental focus, sustain clean energy, and keep my brain firing on all cylinders throughout the day and after speaking with the team, they’ve agreed to give you an exclusive 30% off your order: Grab yours here.

Imagine one of the greatest tennis players of all time made more money from a single shoe investment than from winning 20 Grand Slam titles?

Meet Roger Federer tennis' first billionaire!

With a net worth of $1.3 billion according to Bloomberg's Billionaire Index, Federer has joined the ultra-exclusive club of athlete billionaires alongside Michael Jordan ($3.5 billion) and Tiger Woods ($1.36 billion).

But here's the kicker: his $130.6 million in prize money over 24 years makes up just a fraction of his wealth. The real story? A casual shoe purchase by his wife that turned into a $500 million windfall.

This is how the Swiss maestro built one of the most sophisticated business empires in sports history.

The Champion's Foundation

Born in Basel, Switzerland, Roger Federer dominated men's tennis for nearly two decades. The numbers tell an incredible story:

20 Grand Slam singles titles

103 ATP titles total

World No. 1 for 237 consecutive weeks

$130.6 million in career prize money

8 Wimbledon titles, 6 Australian Opens, 5 US Opens, 1 French Open

Federer claimed 16 of his 20 Slams from 2003 to 2010, reigning supreme in men's tennis throughout the 2000s.

But while his on-court achievements were legendary, his off-court business strategy was revolutionary.

The Endorsement Empire That Started It All

From early in his career, Federer understood that his greatest asset wasn't just his forehand—it was his brand.

The Major Partnerships:

Rolex (2006-present): First signed a 10-year, $15 million deal in 2006 ($1.5M annually), one of the largest endorsement deals ever made for an athlete at that time. When renewed in 2016, estimated at $8 million annually.

Nike (1998-2018): 20-year partnership that built his global brand Uniqlo (2018-present): Signed a 10-year, $300 million deal in 2018 Wilson: Racket sponsorship throughout career Mercedes-Benz: Long-term automotive partnership

Credit Suisse/UBS: Swiss banking relationship

The business insight: Federer built long-term partnerships with premium brands that matched his image of elegance and excellence.

Reports suggest Federer earns around $90-95 million per year from endorsements alone, making him one of the highest-paid retired athletes in the world.

The $500 Million Shoe Investment That Changed Everything

Here's where Federer's story becomes a masterclass in spotting opportunity.

2019: Federer's wife, Mirka, casually purchased sneakers from a Swiss brand called On during a shopping trip. She loved them. So did their friends.

Roger tried them. Loved them too.

The strategic move: Instead of just becoming a customer, Federer reached out for a partnership and bought a 3% stake in On as part of an endorsement agreement after his split with Nike.

The timing was perfect:

On was a Swiss company (hometown loyalty)

Premium positioning in athletic footwear

Revolutionary "cloud" technology in their soles

Growing but not yet mainstream

When On went public in September 2021, shares were sold at $24

Today's value: On is now worth about $17 billion, meaning Federer's 3% stake is worth at least $500 million.

The mathematics are staggering:

Initial investment: Undisclosed (likely low millions)

Current value: $500+ million

Return multiple: 100x+ estimated return

Federer's cut from this single investment has earned him more than triple his entire tennis career prize money.

The On Partnership Strategy

Federer didn't just invest and walk away. He built a comprehensive partnership:

Product Development:

"The Roger Pro" tennis shoe launched in 2021, designed with Federer's input

The shoe blends his on-court legacy with On's proprietary technologies like LightSpray™ (a responsive midsole system)

Brand Ambassador Role:

Face of the premium tennis line

Authenticity and technical innovation—avoiding overexposure pitfalls of celebrity-endorsed products

Company Growth Impact: On reported 29% jump in year-over-year first-quarter sales worth 508 million Swiss francs ($560 million), surpassing the half-billion mark for the first time.

Direct-to-consumer sales saw a 49% increase during the same period—significant growth for the sportswear company.

The Complete Business Portfolio

Federer's wealth isn't just from tennis and shoes. His empire spans multiple verticals:

Real Estate Portfolio:

$30 million estate in Herrliberg, Switzerland

$23 million penthouse in Dubai

Properties across multiple countries

Investment Portfolio:

On Running stake: $500+ million

Various Swiss companies and startups

Conservative investment strategy focused on long-term value

Ongoing Revenue Streams:

Exhibition matches: 2024-25 Legends Tour across Asia and Europe

Brand appearances: High-fee appearances maintaining visibility

Media deals: Documentaries, promotional campaigns

Licensing: Image and likeness deals

Philanthropy as Brand Building:

Roger Federer Foundation: Focus on education for African and Swiss children

Millions donated enhancing public image and brand value

The Numbers Behind the Billionaire Status

Roger Federer's $1.3 billion net worth breakdown (2025 estimates):

On Running stake: $500+ million (38%)

Endorsement contracts/royalties: $400+ million (31%)

Real estate portfolio: $200+ million (15%)

Investment portfolio: $100+ million (8%)

Cash and liquid assets: $100+ million (8%)

Annual income streams (post-retirement):

Endorsements: $90-95 million

Exhibition matches: $10-15 million

Investment returns: $25-50 million

Speaking/appearances: $5-10 million

Total estimated annual income: $130-170 million

The Strategic Moves That Built Billions

1. Long-term Brand Partnerships Federer avoided the pitfalls of overexposure, instead focusing on authenticity and technical innovation.

2. Premium Positioning Associated with luxury brands (Rolex, Mercedes) that matched his elegant playing style

3. Geographic Loyalty Maintained strong Swiss identity, partnering with Swiss companies when possible

4. Patient Capital Federer's On stake teaches investors to prioritize long-term brand equity over short-term gains.

5. Authentic Partnerships Only endorsed products he actually used and believed in

The Market Performance That Proves the Strategy

On's incredible growth trajectory: 1-year return (as of 6/2025): 34.49% (vs. S&P 500's 12.59%) 3-year return: 186.99% (vs. S&P 500's 58.28%)

The business fundamentals driving growth: Direct-to-Consumer (DTC) sales surged 40.3% in 2024, now representing 48.8% of Q4 2024 sales, as the brand prioritizes high-margin retail channels.

Market expansion: On now has elite roster of athletes, including Iga Świątek, Ben Shelton, João Fonseca, and Zendaya as brand ambassador after her role in the tennis-themed movie Challengers.

The Exclusive Billionaire Athlete Club

Federer joins only a handful of sports stars with net worth over $1 billion, including basketball player Michael Jordan ($3.5 billion) and golfer Tiger Woods ($1.36 billion).

What sets billionaire athletes apart:

Multiple revenue streams beyond their sport

Strategic equity investments

Long-term brand building

Premium market positioning

Smart financial management

The Business Lessons from the Swiss Maestro

1. Invest in What You Know and Use Federer's wife initially purchased the brand's sneakers during a casual shopping trip, authentic interest led to investment.

2. Think Long-term While others chase quick deals, Federer built relationships that compound over decades

3. Quality Over Quantity On's restrained expansion prioritising quality stores over quantity, shows that scale without strategy can destroy value.

4. Brand Alignment Matters Seek partnerships with scandal free icons brands aligned with enduring, respected figures are more likely to build lasting loyalty.

5. Premium Pricing Power Focus on companies that justify high margins through innovation and brand prestige.

The Post-Retirement Revenue Machine

Even after retiring in 2022, Federer's earning power remains extraordinary:

Exhibition Tours: Sold-out appearances generating millions

Brand Ambassadorships: Ongoing partnerships with major corporations Media Appearances: Documentaries and promotional content

Speaking Engagements: High-fee corporate and university addresses

The key insight: "Life really is much bigger than the court," Federer said to graduates in 2024. His business empire proves that athletic excellence can be a launching pad for generational wealth.

The Blueprint for Modern Athletes

Federer's path from tennis champion to billionaire businessman offers a roadmap for any athlete or high-performer:

Build authentic relationships with premium brands that match your values

Invest in companies you understand and personally use

Think equity, not just endorsement fees ownership creates lasting wealth

Maintain your reputation as your most valuable asset

Plan for post-competition life from the beginning of your career

Your Takeaway

You might not have 20 Grand Slams or global name recognition, but Federer's core principles work at any scale:

Spot authentic opportunities in your daily life, what products do you and your network genuinely love?

Think like an owner, not just a customer how can you get equity in businesses you support?

Build long-term relationships with quality people and companies in your industry

Invest in what you understand Federer knew tennis, premium brands, and Swiss quality

Be patient with compound returns his On investment took years to reach $500M value

What authentic opportunity are you overlooking in your own life?

What brand or product do you use daily that could benefit from your expertise and network?

How can you think like an owner instead of just a consumer?

The next Roger Federer might not be holding a tennis racket they might be holding equity in the next breakthrough company.

Keep building,

David