Why 99% of Beauty Brands Fail to Hit £300M (Is Sephora the answer?)

Hey there,

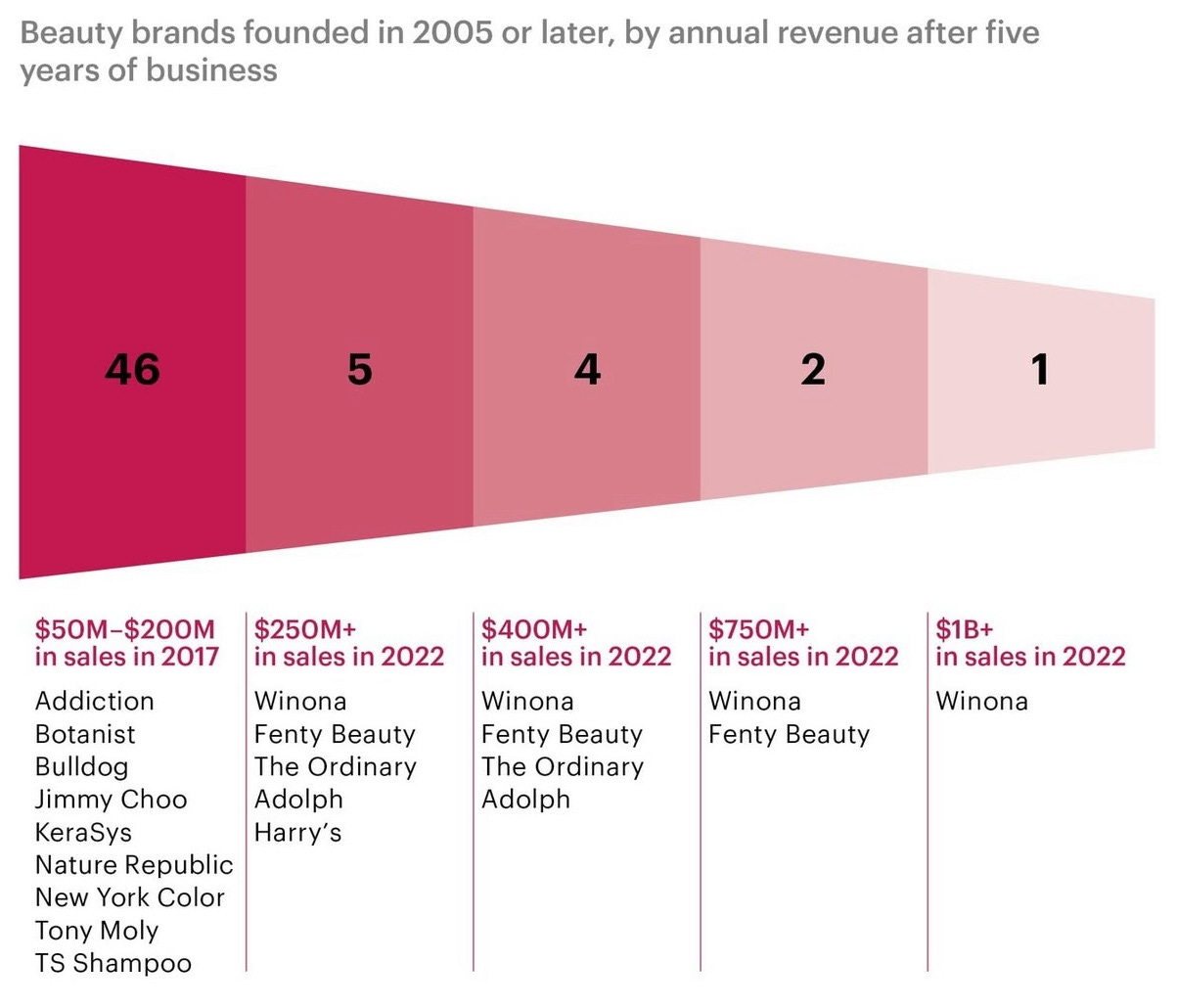

Since 2005, only a handful of new beauty brands have scaled past £300 million in retail sales after five years.

Meanwhile, the global beauty market hit £334 billion in 2024, growing 10% year-over-year. The category is absolutely booming.

So why do 99% of brands fail to capture any meaningful piece of a £334 billion pie that’s growing at 10% annually?

The answer isn’t what most people think. It’s not about better formulations or prettier packaging or more Instagram followers.

It’s about understanding a fundamental truth that most founders ignore until it’s too late: The beauty industry doesn’t reward great products. It rewards products that work within the system.

Let me show you what the 1% know that the 99% don’t.

The Gatekeeper Problem Nobody Talks About

Two entities essentially control whether your beauty brand succeeds or fails.

Gatekeeper #1: Sephora

Let’s talk numbers that should make every founder pay attention:

£13.4 billion in revenue in 2023 (record year)

Targeting £15 billion in the near term

Tens of millions of loyalty members creating a compounding flywheel

Sephora at Kohl’s alone did £1.05 billion in 2023

A single partnership with Kohl’s generated over a billion pounds.

Sephora is a profit engine for LVMH and a kingmaker for beauty brands. If Sephora decides you’re not worth the shelf space, you’re not hitting £300 million. Full stop.

Gatekeeper #2: The Prestige Channel

US prestige beauty hit £23.8 billion in 2023, up 14% year-over-year. Meanwhile, mass beauty grew just 6%.

High-end prestige wins. Low-end impulse wins. The squeezed middle where most new brands position themselves struggles.

The Distribution Power Law That Kills Brands

The dynamics that matter:

1. Discovery happens in-store Despite all the DTC hype, most beauty purchases still happen in physical retail. Sephora stores are where customers discover brands, even if they later buy online.

2. Loyalty compounds Sephora’s tens of millions of loyalty members create a network effect. They get exclusive access, early launches, points rewards. This creates stickiness that DTC brands can’t replicate.

3. Shelf space is finite For every new brand Sephora adds, another gets pushed out or relegated to less prominent placement. It’s a zero sum game.

4. Retailer economics trump brand economics Your 60% gross margin doesn’t matter if Sephora can’t make money on your brand. If you don’t deliver strong sales per door per week, you’re gone.

The CAC Crisis Nobody Admits

Let me share the numbers that explain why so many DTC beauty brands are quietly dying:

Post-2021 Reality:

Social CPMs (cost per thousand impressions) jumped 22% and stayed elevated

Search CPCs (cost per click) rose 23% and stayed elevated

Apple’s ATT privacy changes killed targeted advertising effectiveness

Translation: Customer acquisition costs have roughly doubled whilst targeting effectiveness halved.

What this means practically:

Before 2021, a beauty brand might acquire a customer for £15-20 through Facebook ads. Today, that same customer costs £30-40. And you’re less certain they’re your target demographic.

If your product sells for £30 with 60% gross margin (£18 gross profit) and acquisition costs £35, you’re losing £17 on every customer.

“But lifetime value!” you say. Sure if 40% of customers repurchase within 90 days. Most beauty brands see 15-20% repurchase rates.

Your gross margin isn’t the gate anymore. Your contribution margin after media, shipping, and packaging is. And for most DTC brands, that contribution margin is negative.

They either launched with retail distribution (bypassing high CAC entirely) or they had built-in audiences that drove organic acquisition.

The China Blueprint

The only “new” brand in recent years to clear £750 million is Winona a Chinese brand you’ve probably never heard of.

Winona’s parent company Botanee reported £569 million revenue in 2022 with strong profitability.

How they did it differently:

1. Functional/dermatological positioning Not “clean beauty” or “inclusive beauty.” Medical-grade credibility that justifies premium pricing.

2. Medical channel distribution Built credibility through dermatologist recommendations before going mass market.

3. Domestic distribution advantages Understood the Chinese retail ecosystem and built specifically for it.

The lesson: Western DTC-first playbooks don’t travel. Every market requires a market-specific strategy. What works on Instagram in LA doesn’t work on Douyin in Shanghai.

Why Fragrance Brands Are Winning

Whilst makeup and skincare brands struggle, fragrance is having a moment. Why?

The “affordable luxury” effect.

When consumers feel economic pressure, they trade down on big purchases (cars, homes, holidays) but trade up on small luxuries that make them feel good (£80 perfume instead of £25).

Fragrance is the perfect affordable luxury:

Premium price point (£60-150)

Emotional purchase (not functional)

Gift-able (drives holiday/occasion sales)

High perceived value (expensive-feeling packaging)

In the US, prestige beauty grew 14% in 2023, with fragrance leading the charge. Mass beauty only grew 6%.

If you’re launching today, fragrance-adjacent storytelling and derm-credible skincare are where the growth actually is. “Clean beauty” and “inclusive makeup” are mature, saturated categories.

Based on analysing the handful of brands that have broken through to £300 million+, here’s what actually works:

1. Own a Non-Negotiable Consumer Tension

Not a positioning. Not a USP. A genuine tension that underpins multiple products.

Examples:

Fenty: Representation (40 foundation shades wasn’t a feature it was a movement)

The Ordinary: Radical transparency (showing ingredients and prices destroyed industry opacity)

Winona: Clinical credibility (derm-grade efficacy at scale)

What doesn’t work: “We’re cleaner/better/more sustainable.” Everyone says that. You need something that fundamentally challenges how the category works.

The test: If your brand disappeared tomorrow, would your customers genuinely feel like something irreplaceable was lost? If not, you don’t have a real tension.

2. Build for Retailer Economics, Not Just Brand Gross Margin

Here’s what most founders optimise for:

Product cost: £8

Sell price: £25

Gross margin: 68%

“We’re profitable!”

Here’s what actually matters:

Retailer Math:

Your wholesale price: £12.50 (50% off retail)

Retailer’s cost after shrink/returns: £13.50

Retailer’s required margin: 45%

Retailer’s shelf space cost: £200/door/week

Required sales per door per week: £800+

If your product can’t clear £800/door/week without 40%+ promotional discounting, Sephora won’t carry you long-term.

The winners design for this from day one:

Hero products with high velocity and strong repurchase

Price architecture that allows retailer margin + promotional flexibility

Packaging that creates in-store theater and discoverability

Education/sampling programmes that drive trial without eating retailer margin

The losers design for Instagram aesthetics and hope retail “figures it out later.”

3. Treat Loyalty as Your Second P&L

Retail loyalty programme isn’t just a nice-to-have. It’s the entire business model.

Prestige momentum is being driven by loyalty ecosystems where:

Members get exclusive access and early launches

Points drive repeat purchases

Tier systems encourage trade-up behaviour

Data allows personalised recommendations

For brands, this creates an opportunity: If you can tap into retail loyalty ecosystem through exclusive launches, member-only products, or points multipliers, you access millions of high-value customers for free.

But you have to design for it: Products that work for loyalty programs have different characteristics than products designed for Instagram virality.

Loyalty-friendly products:

Consumable with predictable repurchase (30-90 days)

Travel/deluxe sizes that work as point redemptions

Stackable with promotions without destroying margin

High perceived value at the price point

4. Ruthlessly Manage Contribution Margin

With media inflation and targeting degradation, your P&L has to be instrumented differently.

Old model: Revenue £100 COGS £40 Gross Margin £60 (60%)

“We’re highly profitable!”

New model: Revenue £100 COGS £40 Shipping £8 Packaging £3 Payment processing £3 Pick/pack £4 Returns £6 Marketing £35

Contribution Margin £1 (1%)

“We’re... barely surviving.”

The winners re-architect everything:

Bundle hero + consumable to increase AOV and reduce per-unit costs

Design packaging that’s Instagram-worthy but costs 40% less

Negotiate 3PL contracts with volume commitments

Build replenishment/subscription to lower blended CAC

Use retail to offset DTC customer acquisition costs

Every pound matters when you’re operating at 1% contribution margin.

5. Go Where the Growth Actually Is

Right now, that’s:

Prestige beauty (growing 14% vs. 6% for mass)

Fragrance-led storytelling (affordable luxury in tough times)

Derm-adjacent skincare (clinical credibility justifies premium)

What’s not growing:

Generic “clean beauty” (saturated, commoditised)

Inclusive makeup without distribution (Fenty already won)

DTC-only brands (CAC killed the model)

If you must play mass: Do it with retailer-specific innovation and value engineering. Target and Walmart want different products than Sephora, not worse versions of the same thing.

The Brands That Might Actually Make It

Looking at the current landscape, here are the emerging brands with the model (not just the marketing) to potentially hit £300M+:

Brands with a shot:

1. Topicals

Strong derm-credible positioning (hyperpigmentation, clinical ingredients)

Prestige distribution (Sephora)

Clear consumer tension (representation in clinical skincare)

Solid contribution margin model

2. Experence (emerging)

Fragrance meets skincare positioning

Premium price point with strong retailer economics

Built for prestige distribution from day one

3. Vacation (sunscreen)

Category disruptor with strong POV

Premium positioning in growing category

Retail-ready from launch

Brands that probably won’t:

Most DTC-first brands with 100K Instagram followers, high CAC, no retail distribution, and “we’re cleaner/better” positioning. They’ll plateau at £10-30 million and either sell for scraps or shut down when funding dries up.

What This Means for Founders

If you’re building a beauty brand today, here’s the harsh reality check:

You need:

A genuine consumer tension that sustains multiple products

Retail-ready economics from day one (not “we’ll figure that out later”)

A plan to tap into existing loyalty ecosystems (Sephora, Ulta)

Contribution margin discipline that accounts for real CAC

Category positioning where growth actually exists

You don’t need:

A celebrity founder (helpful but not sufficient)

Perfect Instagram aesthetics (necessary but not sufficient)

“Clean” or “sustainable” positioning (table stakes, not differentiators)

A viral TikTok moment (nice to have, doesn’t predict scale)

The brutal truth: If your pitch is “We’re like [successful brand] but cleaner/better/more sustainable,” you don’t have a business. You have a feature that will be copied by the incumbents you’re trying to disrupt.

What This Means for Investors

If you’re investing in beauty, here’s your diligence checklist:

Green flags:

✅ Contribution margin positive before growth capital

✅ Credible path to retail placement

✅ Clear answer to “why can’t Estée Lauder/L’Oréal copy this?”

✅ Prestige positioning with retailer-friendly economics

Red flags:

❌ Negative contribution margin “but LTV justifies it”

❌ No plan/path to get into retail

❌ Positioning is just “cleaner/better/more sustainable”

❌ Assumes CAC will decrease with scale (it won’t)

The question to ask: “If a retailer said yes today, would your unit economics work at their required velocity and margin?”

If the answer is no (or “we’d have to adjust pricing/packaging/margin”), you’re investing in a brand that isn’t ready for the only distribution that matters.

The Upside Is Still Massive If You Play the Right Game

Let me end on a positive note: The opportunity in beauty is genuinely massive.

The market is growing (£334B at 10% annual growth)

Retail platforms are accelerating (Sephora targeting £15B)

Consumers are willing to trade up (prestige +14% vs. mass +6%)

But you have to play the game that actually exists, not the game you wish existed.

The game that exists:

Prestige positioning with mass-market ambitions

Loyalty ecosystem participation

Contribution margin discipline

Clinical or cultural credibility that’s defensible

The game that doesn’t exist anymore:

Instagram virality driving sustainable growth

“Better ingredients” as moat

Customer acquisition costs decreasing with scale

The brands that win the next decade will look more like Winona (clinical credibility, specific consumer tension

Your Takeaway

Only a handful of beauty brands have scaled past £300 million in the last 20 years.

Because scaling beauty requires understanding a system and most founders just see a product category.

The system is:

Retailer gatekeepers with specific economic requirements

Loyalty ecosystems that compound for participants

CAC realities that kill undisciplined brands

Category dynamics that reward specific positions

Which game are you actually playing?

Keep building,

David

P.S. Sephora’s partnership with Kohl’s did £1.05 billion in 2023. That’s more revenue than 99% of beauty brands will ever see.

Fascinating! I Wonder…. Can any of this be applicable to Garms? 💭